Merchant Adoption and Consumer Adoption

12 Apr 2015There was a big push to get more merchants to accept cryptocurrencies through the later stages of 2013 and early 2014. That resulted in a number of big merchants signing up to accept Bitcoin such as Microsoft and Dell. The news of Paypal taking another step towards accepting Bitcoin is the latest indication that if there is demand merchants are likely to jump on board. Unfortunately most of what I have seen suggests that the number of sales in Bitcoin is below what the companies expected and there is some evidence of that from some companies public comments.

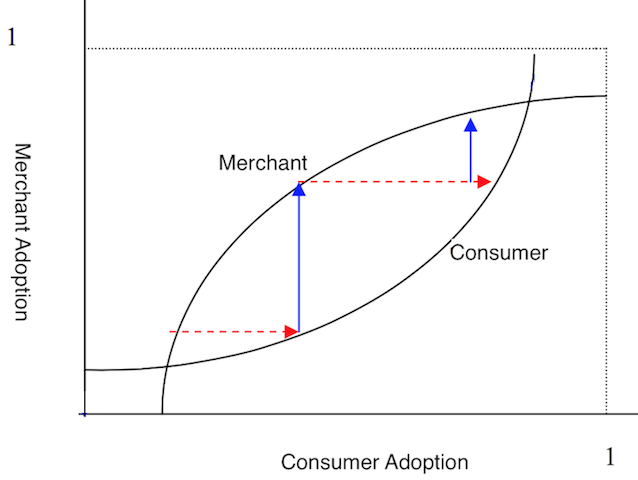

This suggests that we are seeing merchants adoption fast out-pacing consumer adoption. If we consider that most companies accepting Bitcoin are not keeping it as a currency, rather they use it as a payment network. The fact that merchants aren't holding Bitcoin is creating an interesting dynamic which seems to be quite closely related to how smart-cards are adopted(e.g. Oyster card in London, Octopus card in Hong Kong). Using Rochet and Triole's model for two sided markets we end up with a model similar to the one shown below.

The diagram shows how adoption occurs when there are two parties that need to adopt the technology. For payment technologies, the market tends to be bootstrapped by customers and individuals, this is represented by the consumer line before the first intersection and the first red arrow. These customers or individuals using the technology then starts to draw in merchants who wish to capitalise on the way these individuals are choosing to spend their money which results in merchants adopting the technology at a much faster rate, as shown by the first blue line.

We appear to currently be in a stage where the adoption by merchants has far outstripped the demand for consumers to spend Bitcoin (i.e. somewhere on one of the red lines). So my guess is that we won't see as many major companies accepting Bitcoin in 2015, or until we see an increase in willingness for consumers to buy things with Bitcoin which is usually occurs when the price increases.

Bitcoin is a bit different to other payment technologies in that it is a deflationary currency. So there is a strong disincentive for customers to spend their money. As such I'd expect the consumer curve to be quite slow to rise as shown by the second red arrow. As most of the benefits for using cryptocurrencies are on the merchant side, we may also see a steeper rise in merchant acceptance, but this seems less likely as most adoption decisions for payment systems are driven by customer demand.

Some merchants have offered discounts to try and get more users buying with Bitcoin, but I'm not aware of any companies that have released any numbers around how a discount impacts usage of Bitcoin. Of course discounts are likely to increase sales, but by how much, or more interestingly at what price did the consumers buy their Bitcoin at. Knowing the price that users bought in at would allow us to get some understanding as to when people start spending a deflationary currency by choice.

Most theorising around deflationary currencies implies that people only spend it when they have to, because the money will be worth more tomorrow, so the longer you hold out the better value you are getting for your money. But there appears to be a degree of discretionary spending of Bitcoin as seen by the trivial nature of many of the first products (Alpaca socks anyone?). But this spending also mostly seems to occur with those who have seen exponential increases in value of their bitcoins.

But what happens with adoption is largely uncharted territory. Currency adoption academic literature would suggest that it is all but impossible. But if it is thought of as an alternative to the current system that can be used in tandem, it currently resembles how technology diffuses through society with a group of passionate early adopters who drive it into the mainstream.

Consumer side adoption will also be impacted by the decreasing price of Bitcoin as a large portion of the Bitcoin community still believes the price will go up, or are currently bearing losses on their purchases. People are less likely to spend their Bitcoin if they have to spend it at a loss.

In the meantime we are seeing traders increasing the volume of trades as the traders try and profit off the volatility of the currency rather than looking for an absolute high price which attracted the speculators which drove the price up in late 2013. For Bitcoin, 2015 may just be the year of the trader.