25 Sep 2015

I started building a messaging app in Ionic yesterday, and a core feature of any decent messaging app is the push notifications. But unfortunately they aren't the simplest thing to include when you want to send them from the actual app!

There are a fair few gotchas which you need to think about before you can get anything happening in the development environment.

Ionic Push seems to be a easy system to send your push notifications, and they have a great post on how to get up and running with their development notifications so you can test your apps from the browser. This is great for sending notifications to the client either typing "ionic push -s" into your terminal or using a curl request like this:

curl -u your-private-api-key: -H "Content-Type: application/json" -H "X-Ionic-Application-Id: your-app-id" https://push.ionic.io/api/v1/push -d '{"tokens": ["your", "target", "tokens"], "notification":{"alert":"Hello World!"}}'

But you'll very quickly realise that all the documentation is talking about how to create a push notification from a server rather than your app initiating the notification.

The way that Ionic Push is designed lends it well to servers initiating the push notification, and for a lot of services that works fine, but if you want to create a push notification from an event inside the app that you are making then a different approach needs to be taken. Ionic Push requires that you send your secret API key with each notification an intermediary server is needed between the device creating the notification and Ionic's servers.

To get around this, I created a small express server which will accept a post request from the app, which contains the data that needs to be sent for the notification. The server will then create a new post request including all the sensitive data that is needed, such as the private API key mentioned above, which is not something that should be included on the clients application for security reasons.

As an example, the server I created is available on github

How this translates into actual push notifications is another problem in itself, but this should be enough to get you up and testing your own push notifications with Ionic and Ionic Push.

12 Apr 2015

There was a big push to get more merchants to accept cryptocurrencies through the later stages of 2013 and early 2014. That resulted in a number of big merchants signing up to accept Bitcoin such as Microsoft and Dell. The news of Paypal taking another step towards accepting Bitcoin is the latest indication that if there is demand merchants are likely to jump on board. Unfortunately most of what I have seen suggests that the number of sales in Bitcoin is below what the companies expected and there is some evidence of that from some companies public comments.

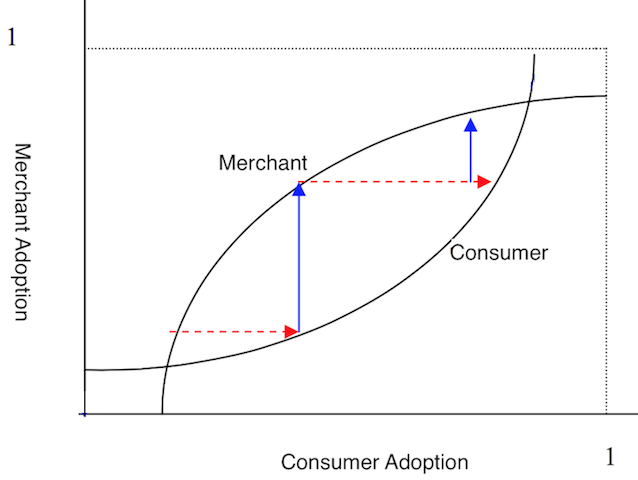

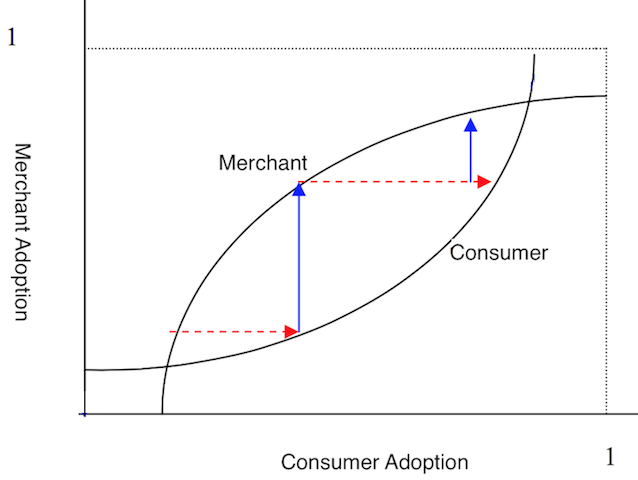

This suggests that we are seeing merchants adoption fast out-pacing consumer adoption. If we consider that most companies accepting Bitcoin are not keeping it as a currency, rather they use it as a payment network. The fact that merchants aren't holding Bitcoin is creating an interesting dynamic which seems to be quite closely related to how smart-cards are adopted(e.g. Oyster card in London, Octopus card in Hong Kong). Using Rochet and Triole's model for two sided markets we end up with a model similar to the one shown below.

The diagram shows how adoption occurs when there are two parties that need to adopt the technology. For payment technologies, the market tends to be bootstrapped by customers and individuals, this is represented by the consumer line before the first intersection and the first red arrow. These customers or individuals using the technology then starts to draw in merchants who wish to capitalise on the way these individuals are choosing to spend their money which results in merchants adopting the technology at a much faster rate, as shown by the first blue line.

We appear to currently be in a stage where the adoption by merchants has far outstripped the demand for consumers to spend Bitcoin (i.e. somewhere on one of the red lines). So my guess is that we won't see as many major companies accepting Bitcoin in 2015, or until we see an increase in willingness for consumers to buy things with Bitcoin which is usually occurs when the price increases.

Bitcoin is a bit different to other payment technologies in that it is a deflationary currency. So there is a strong disincentive for customers to spend their money. As such I'd expect the consumer curve to be quite slow to rise as shown by the second red arrow. As most of the benefits for using cryptocurrencies are on the merchant side, we may also see a steeper rise in merchant acceptance, but this seems less likely as most adoption decisions for payment systems are driven by customer demand.

Some merchants have offered discounts to try and get more users buying with Bitcoin, but I'm not aware of any companies that have released any numbers around how a discount impacts usage of Bitcoin. Of course discounts are likely to increase sales, but by how much, or more interestingly at what price did the consumers buy their Bitcoin at. Knowing the price that users bought in at would allow us to get some understanding as to when people start spending a deflationary currency by choice.

Most theorising around deflationary currencies implies that people only spend it when they have to, because the money will be worth more tomorrow, so the longer you hold out the better value you are getting for your money. But there appears to be a degree of discretionary spending of Bitcoin as seen by the trivial nature of many of the first products (Alpaca socks anyone?). But this spending also mostly seems to occur with those who have seen exponential increases in value of their bitcoins.

But what happens with adoption is largely uncharted territory. Currency adoption academic literature would suggest that it is all but impossible. But if it is thought of as an alternative to the current system that can be used in tandem, it currently resembles how technology diffuses through society with a group of passionate early adopters who drive it into the mainstream.

Consumer side adoption will also be impacted by the decreasing price of Bitcoin as a large portion of the Bitcoin community still believes the price will go up, or are currently bearing losses on their purchases. People are less likely to spend their Bitcoin if they have to spend it at a loss.

In the meantime we are seeing traders increasing the volume of trades as the traders try and profit off the volatility of the currency rather than looking for an absolute high price which attracted the speculators which drove the price up in late 2013. For Bitcoin, 2015 may just be the year of the trader.

28 Aug 2014

TL;DR If you are a business owner/founder and sell a product please take 15 minutes to talk to me about why you decided to accept/not accept Bitcoin.

Bitcoin and the underlying technical innovations of the blockchain and digital scarcity are some of the most exciting developments occurring at the moment. A large portion of the academic community around cyrptocurrencies are mainly interested in understanding/advancing either the technical underpinnings of these innovations, or the effects of cyrptocurrencies at a broad macroeconomic level.

I want to take a step back and understand what it is that is causing people to use Bitcoin. There are people who are tracking adoption metrics, others who are looking more directly at the community and a number of developments on the academic side as well.

There has been very little to no research into why merchants actually decide to accept Bitcoin, or on the flip side the biggest issues that they see in accepting it. Although this is only one half of the equation it is an important step in legitimising Bitcoin and it's usage.

As part of my research I'm aiming to answer the question of what factors are presenting the biggest roadblocks to merchants, so I'm putting this out there as an open call to the Bitcoin community. If you know about Bitcoin and own/work in a small business that sell a product I'd love to have a quick 15 minute chat about your thoughts on why you chose to accept (or not accept) Bitcoin.

You can grab a time with me here if you have 15 minutes to talk about your business and why you do/don't accept Bitcoin

30 Jul 2014

So, why am I starting a journal?

I felt that I needed to start recording down both what I'm doing, and my thoughts/opinions as they stand. At the moment it will largely be around Bitcoin and other cryptocurrencies. Given my current area of study I will focus on areas around merchant adoption, but that doesn't mean that I won't write about other areas that interest me.

Putting this journal online gives me a record of what I thought, and how that changes over time. Additionally it will hopefully force me to clarify my thoughts by organising it in a coherent structure rather than just abstract thoughts in my head. I've decided to not call it a blog as the ideas that I'm aiming to present are closer to evergreen content, things that aren't just flashes in the pan, but rather content that lasts, well at least as well as anything last in technology. In addition articles are likely to be updated and changed to try and keep them up to date and relevant when appropriate.

My personal reasoning behind this is a little selfish in that I've tried keeping journals, I've tried to write little notes to myself, and I simply forget after a few weeks. Writing is something that tends to slip through the cracks. So, having a public forum to present my ideas might force me to be more regular, thorough and hopefully insightful with my ideas.

Beyond the purpose of self development some of the ideas that I'm working on might provide some benefit to the broader community. My work on understanding the adoption of Bitcoin is not from the more common Economic/Financial or Engineering/Computer Science perspective that makes up most of the academic literature, and most of my thoughts fall somewhat outside the echo chamber of Reddit and their Bitcoin community. So providing a somewhat Information Systems centric view on the cryptocurrency community may create some novel insights.

Hopefully the articles prove useful.

25 Jul 2014

I decided that it would be a good exercise to build my own site for this journal rather than just doing some slight customisations on a Wordpress/Ghost or other CRM. It seemed like a good place to start for the first web development I've done solo, and it hasn't turned out too badly (I hope)!

When I started to look into the tools that I could use to build this site, there were way too many options, but when I found Jekyll it seemed like it would be perfect for me. Not only it is a really easy way to get a static site up and running, GitHub hosts the site for free on their Pages service. It was a bit intimidating starting out from scratch though, so I started to look for templates to base the site on. After a few months distraction with Uni, and building a separate site using Jekyll I felt a bit more confident in building something largely from scratch.

So after blundering around trying to build something from scratch, and playing around with designs I decided to based my site off another site and then progressively change it. This helped me get over the felling of being totally overwhelmed with having to put the whole site together. I settled on using the Hyde theme by @mdo as an initial base for the site. As the site is also a profile of me I decided to change the landing page to what you see today, sort of a summary of me, a mini resume I guess.

I haven't done much yet to customise the journal aspect but that is a work in progress as we speak and there will be updates progressively pushed through as articles are put onto the site.